Start your savings journey

-

Take the first step

There’s no minimum to open a CollegeBound Saver account. It’s easy to start saving in a way that fits your budget.

-

Save on your terms

You can set up recurring contributions for as little as $1 per month.1

-

Low-cost portfolios

Depending on which investment options you choose, the yearly cost for Rhode Island residents ranges from 0.02-0.31%. If you invest $1,000, that means your annual cost can be as low as 20 cents.

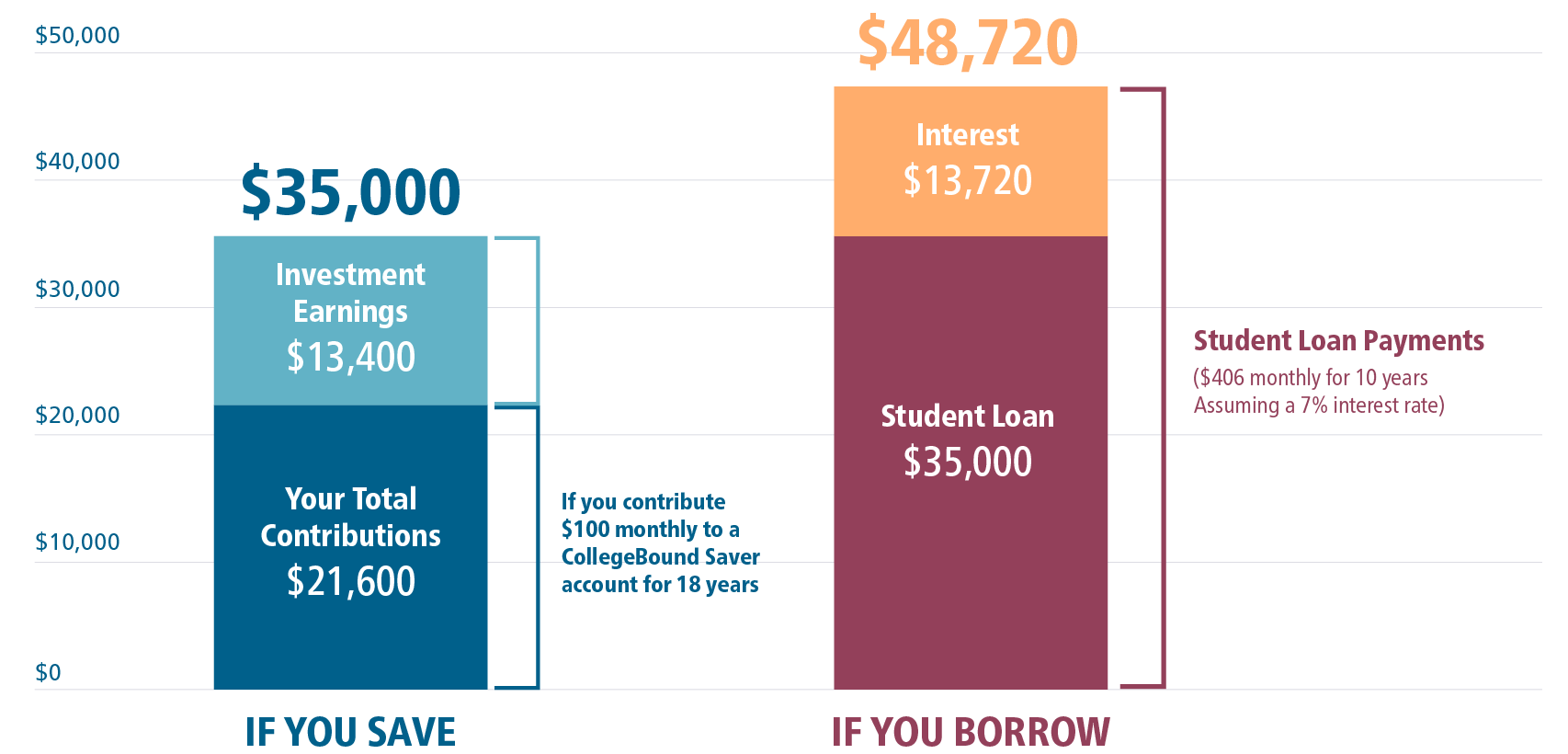

Saving now can help you later

College is expensive. Saving for it doesn’t have to be. Starting early and saving consistently, even small amounts, can pay off later. Compared to borrowing for college, see why saving with a low-cost plan like CollegeBound Saver is a smart idea.

This hypothetical example is for illustrative purposes only and assumes a 5% return and no withdrawals. It does not represent an actual investment in any particular 529 plan and does not reflect the effect of fees and expenses or any taxes payable upon withdrawal. Your actual investment return may be higher or lower than that shown. The loan repayment terms are also hypothetical and may be higher or lower than that shown. A plan of regular investment cannot assure a profit or protect against a loss in a declining market.

1An investment plan of regular investment cannot assure a profit or protect against a loss in a declining market.